Wednesday Morning Joe. 23 August, 2017.

In U.S.

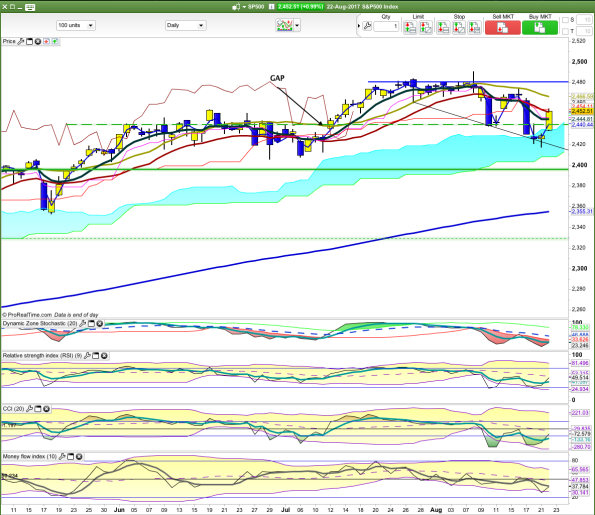

Major indices were all up strongly. A four day reversal pattern (big down day, two doji candles, big up day) has occurred.

DJ +0.9%, Nasdaq +1.36%, SP500 +0.99%, NYA +0.73%, Russell2000 +1.09%.

All sectors were positive. The weakest were both defensive sectors, Consumer Staples +0.02% and Utilities +0.22%. Technology and Financials were both up >1%. That structure indicates a switch into risk-on assets.

SP500:

The SPX finished up +0.99%. Today’s action has taken the chart above the Ichimoku “cloud”. That’s a bullish move. Two indicators CCI and RSI9 have given first degree “buy” signals by breaking above their 5-Day MAs. That’s not a strong signal. We need to see all four indicators move above their middle 20-Day MAs to be really confident, but we have a good first indication that the bulls have gained strength.

Commodities:

DBC +0.27%. Energy +0.68%. Industrial Metals -0.17%. Copper Producers ETF was up +1.97%. Gold -0.45%. Iron Ore +0.9%.

We’ll be positive today and there is a good possibility that the long sideways trend will finally be broken to the upside.

RB.