Saturday Report. 13 February, 2016.

In America:

DJ +2%, SP500 +1.95%, Nasdaq +1.66%, NY Composite +2.21%, Russell 2000 +1.92%.

New Lows on the NYSE decreased sharply from 710 to 139. The NH/NL Ratio is bearish at 14.2%.

American Bonds:

Below is a Relative Strength Chart of 10Yr/30Yr Bonds. When 10Yrs are doing better than 30 Yrs, we see a risk-on market. Expect stocks to do well. We need to see this chart turn up. In the last session, there was a rush to the safety of bonds. This is a risk-off market.

This is the first substantial move up in this chart since the beginning of this month. It needs to get above the 20-Day MA. The move is very positive especially with the +ve divergence on the MACD Histogram. This could signal the end of the down trend in stocks.

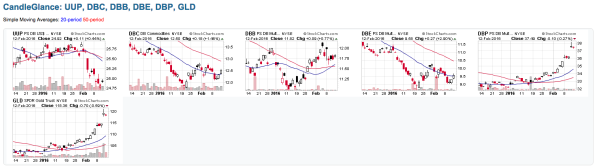

Commodities:

U.S. Dollar last night: UUP up +0.44%. DBC +1.23%, Base Metals +0.77%, Energy +2.9%, GLD +0.77%. GLD -0.59%.

Full Weekly Report tomorrow.

RB