Morning Coffee, Friday, 11 April, 2014

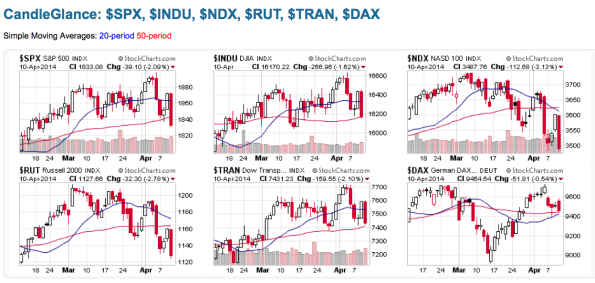

Last night was ugly. SP500 -2.09%, Dow Industrials -1.62%, Nasdaq100 -3.13%, Russell2000 -2.78%, Transports -2.1%. DAX -0.54%.

In about the first hour last night, Dow 30 and SPX fluffed about with not a lot happening. Then the selling started, and it was relentless. Any effort to make a rally was sold into. Nasdaq and RUT were down from the starting bell. They’ve been the weakest, and until we can see a turn-around in those Indices, this market will be bearish.

In about the first hour last night, Dow 30 and SPX fluffed about with not a lot happening. Then the selling started, and it was relentless. Any effort to make a rally was sold into. Nasdaq and RUT were down from the starting bell. They’ve been the weakest, and until we can see a turn-around in those Indices, this market will be bearish.

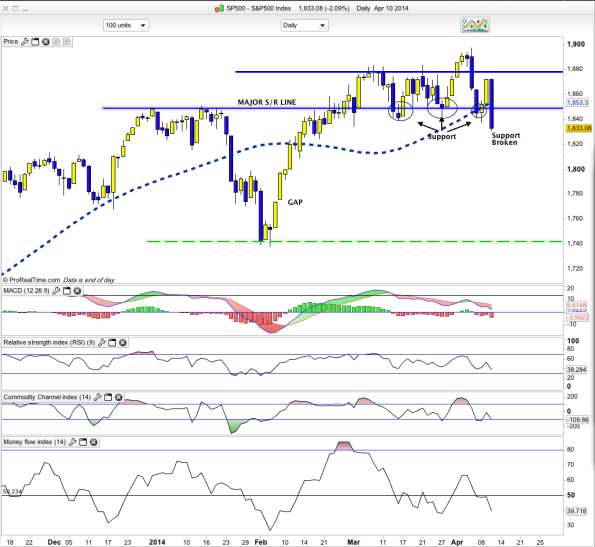

Here’s a more detailed chart of the SP500.

I’ve been talking about the major S/R Line on the chart for some time and saying that if it breaks, the market will be in for a significant pull-back. The obvious target would be the small GAP marked on the chart. Previously I’ve noted other gaps further down on a longer term chart. They’re also possibles. But, let’s see how this goes. This session was so bad, the next one is likely to be a Narrow Range day. And next week is OpEx Week. In recent times, OpEx Week is often bullish.

I’ve been talking about the major S/R Line on the chart for some time and saying that if it breaks, the market will be in for a significant pull-back. The obvious target would be the small GAP marked on the chart. Previously I’ve noted other gaps further down on a longer term chart. They’re also possibles. But, let’s see how this goes. This session was so bad, the next one is likely to be a Narrow Range day. And next week is OpEx Week. In recent times, OpEx Week is often bullish.

Commodities:

CRB Index was up modestly, +0.22%, helped by Precious Metals up +1.18% and Industrial Metals +1.15%. The other three sectors (Livestock, Agriculture and Energy) were down. Our Gold Miners are likely to be the only bright spot in our market today.

CRB Index was up modestly, +0.22%, helped by Precious Metals up +1.18% and Industrial Metals +1.15%. The other three sectors (Livestock, Agriculture and Energy) were down. Our Gold Miners are likely to be the only bright spot in our market today.

Issues relevant to Australia:

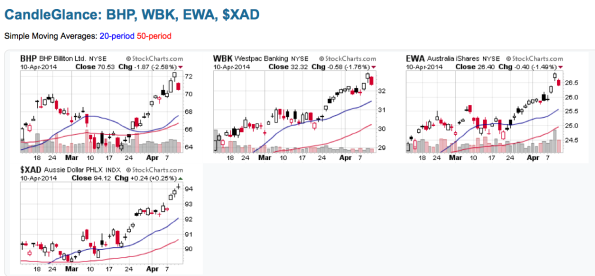

The first three show extremely bearish two-day candle formations. I spent some time in yesterday’s Morning Coffee report on EWA. My bearish view came to fruition today. Our currency is showing a possible “evening star” candle. If that’s followed by a big down candle, any support from our currency for stocks will disappear.

The first three show extremely bearish two-day candle formations. I spent some time in yesterday’s Morning Coffee report on EWA. My bearish view came to fruition today. Our currency is showing a possible “evening star” candle. If that’s followed by a big down candle, any support from our currency for stocks will disappear.

Redbacka